Funds Flow Statement || Solution of account grade 12

Solution of

past question of funds flow statement of Account || Management || |Grade-12 ||

Part 1||

2076 Set B Q. No. 16

Funds from

operation

|

Particular

|

Amount |

Amount |

|

Net

profit of the year Add: Non-operating

expenses |

|

180000 100000 |

|

:-

Patent written off :-

Depreciation of fixed assets |

10000 90000 |

|

|

Less: Non-operating

income :-Profit

on sale of fixed assets |

6000 |

280000 (6000) |

|

Fund

from operation |

|

274000 |

Funds flow

statement

|

Source |

Amt. |

Application

|

Amt. |

|

Fund

from operation |

274000 |

Purchase

of fixed assets |

200000 |

|

Sales

of fixed assets |

15000 |

||

|

Issue

of share capital |

200000 |

Increase

in Working capital |

289000 |

|

|

489000 |

|

489000 |

2076 Set C Q. No. 16

Funds from

operation

|

Particular

|

Amount |

Amount

|

|

Net

profit for the year |

|

80000 |

|

Add:

Non-profit expenses |

|

|

|

:-

Goodwill written off |

20000 |

|

|

:-

Preliminary expenses written off |

10000 |

|

|

:-

Dividend paid |

45000 |

|

|

:-

Depreciation charged in furniture |

15000 |

90000 |

|

|

|

170000 |

|

Less: Non-operating

incomes |

|

0 |

|

Fund

from operation |

|

170000 |

Funds flow statement

|

Source |

Amt. |

Application |

Amt. |

|

Fund from operation |

170000 |

Redemption of loan |

150000 |

|

Issue of share capital |

150000 |

Furniture purchase |

150000 |

|

Decrease in Working capital |

25000 |

Dividend paid |

45000 |

|

|

|

|

|

|

|

345000 |

|

345000 |

2075 GIE Q. No. 16

Funds from

operation

|

Particular |

Amount |

Amount |

|

Net loss for the year |

|

(65000) |

|

Add: Non-operating expenses |

|

|

|

:- Preliminary expenses written off |

5000 |

|

|

:- loss on sales of machine |

20000 |

|

|

:- Depreciation charge on machinery |

25000 |

|

|

:- Dividend paid |

80000 |

1300000 |

|

|

|

65000 |

|

Less: Non-operating incomes |

|

O |

|

FFO |

|

65000 |

Funds flow statement

|

Source |

Amount |

Application |

Amount |

|

Fund from operation |

65000 |

Redemption of debenture |

100000 |

|

Issue of share capital |

200000 |

Furniture purchased |

120000 |

|

Sold of machinery |

130000 |

Dividend paid |

80000 |

|

|

|

Increase in WC |

95000 |

|

|

395000 |

|

395000 |

2075 Set. A Q. No. 16

Funds from

operation

|

Particular |

Amount |

Amount |

|

Net profit for the year |

|

40000 |

|

Add: Non-operating expenses |

|

|

|

:- Goodwill written off |

2000 |

|

|

:- Dividend paid |

25000 |

|

|

:- Depreciation charge |

15000 |

42000 |

|

|

|

82000 |

|

Less: Non-operating incomes |

|

0 |

|

FFO |

|

82000 |

Funds flow statement

|

Source |

Amount |

Application |

Amount |

|

Fund From Operation |

82000 |

Redemption of debenture |

50000 |

|

Dividend paid |

25000 |

||

|

Issue of share capital |

50000 |

Fixed assets purchase |

70000 |

|

Decreasing in WC |

13000 |

|

|

|

|

145000 |

|

145000 |

2075 Set. B Q. No. 16

Funds from

operation

|

Particular |

Amount |

Amount |

|

Net profit for the year |

|

28000 |

|

Add: Non-operating expenses |

|

|

|

:- Goodwill written off |

2000 |

|

|

:- Depreciation on fixed assets |

4000 |

|

|

:- Loss on sales of fixed assets |

2000 |

8000 |

|

|

|

36000 |

|

Less: Non-operating

income |

|

0 |

|

FFO |

|

36000 |

Funds Flow Statement

|

Source |

Amount |

Application |

Amount |

|

Fund From operation |

36000 |

Purchased of fixed assets |

20000 |

|

Issue of share capital |

30000 |

Increase in WC |

58000 |

|

Sales of fixed assets |

12000 |

|

|

|

|

78000 |

|

78000 |

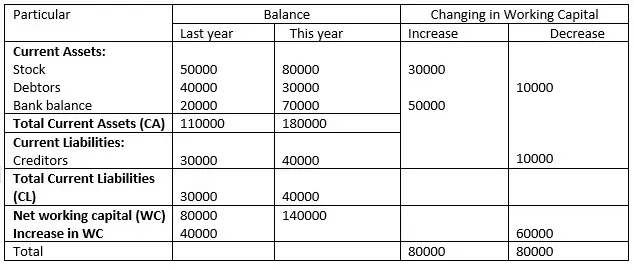

2074 Supp. Q. No. 16

Schedule

of changes in Working Capital

Funds flow

from operation

|

Particular |

Amt. |

Amt. |

|

Net profit for the year |

|

50000 |

|

Add: Non-operating expenses :- Dividend paid |

30000 |

30000 |

|

|

|

80000 |

|

Less: Non-operating incomes :- Profit on sale of machine |

20000 |

(20000) |

|

FFO |

|

60000 |

Working note

Machinery a/c

|

Debit |

Amt. |

Credit |

Amt. |

|

Opening balance of machinery |

90000 |

Closing balance of machinery |

280000 |

|

Purchase |

200000 |

Sold |

30000 |

|

Profit

on sale of machinery |

20000 |

|

|

|

|

310000 |

|

310000 |

2074 Set. A Q. No. 16

Fund from

operation

|

Particular |

Amt. |

Amt. |

|

Net profit for the year |

|

60000 |

|

Add: Non-operating expenses |

|

|

|

:- Transfer to the reserve fund |

10000 |

|

|

:- Goodwill written off |

10000 |

|

|

:- Dividend paid |

20000 |

|

|

Depreciation on machinery |

10000 |

50000 110000 |

|

Less: Non-operating incomes |

|

0 |

|

FFO |

|

110000 |

Fund flow statement

|

Source |

Amt. |

Application |

Amt. |

|

Fund from operation |

110000 |

Redemption of debenture |

90000 |

|

Issue of share capital |

100000 |

Dividend paid |

20000 |

|

Decrease in WC |

10000 |

Transfer to reserve fund |

10000 |

|

|

|

Purchase of Machinery |

110000 |

|

|

|

|

|

|

|

230000 |

|

230000 |

2074 Set. B Q. No. 16

Fund from

operation

|

Particular |

Amt. |

Amt. |

|

Net profit for the year |

|

80000 |

|

Add: Non-operating expenses |

|

|

|

:- Goodwill written off |

25000 |

|

|

:- Dividend paid |

50000 |

|

|

:- Depreciation charged on furniture |

12000 |

87000 |

|

|

|

167000 |

|

Less: Non-operating incomes |

|

0 |

|

Fund from operation |

|

167000 |

Funds flow statement

|

Source |

Amt. |

Application |

Amt. |

|

Fund from operation |

167000 |

10 % Redemption of debenture |

100000 |

|

Issue of share |

100000 |

Dividend paid |

50000 |

|

Decrease in WC |

3000 |

Furniture purchase |

120000 |

|

|

267000 |

|

267000 |

2073 Supp. Q. No. 16

Schedule

of changes in Working Capital

Fund flow statement

|

Particular |

Amt. |

Amt. |

|

Net profit for the year |

|

40000 |

|

Add: Non-operating expenses |

|

|

|

:- Depreciation charge in machinery |

10000 |

|

|

:- Transfer to general reserve |

10000 |

20000 |

|

|

|

60000 |

|

Less: Non-operating income |

|

0 |

|

FFO |

|

60000 |

2073 Set C Q. No. 16

Schedule

of changes in Working Capital

Funds flow statement

|

Source |

Amt. |

Application |

Amt. |

|

Issue of shares |

50000 |

Purchase of machine |

48000 |

|

Decrease WC |

7000 |

Payment of loan |

50000 |

|

Fund from operation |

51000 |

Dividend paid |

10000 |

|

|

108000 |

|

108000 |

2073 Set D Q. No. 16

Schedule

of changes in Working Capital

Funds from statement

|

Particular |

Amt. |

Amt. |

|

Net profit for the year |

|

80000 |

|

Add: Non-operating expenses |

|

|

|

:- Transfer to reserve |

20000 |

|

|

:- Depreciation on fixed assets |

20000 |

|

|

:- Provision for tax |

10000 |

50000 |

|

|

|

130000 |

|

Less: Non-operating

income |

|

|

|

:- Profit on

sales of fixed assets |

5000 |

(5000) |

|

|

|

125000 |

2072 Supp. Q. No. 16

Funds from operation

|

Particular |

Amt. |

Amt. |

|

Net profit for the year |

|

75000 |

|

Add: Non-operating expenses |

|

|

|

:- Goodwill written off |

5000 |

|

|

:- Depreciation on fixed assets |

10000 |

|

|

:- Loss on fixed assets |

2000 |

17000 |

|

|

|

92000 |

|

Less: Non-operating income |

|

0 |

|

FFO |

|

92000 |

Funds flow statement

|

Source |

Amt. |

Application |

Amt. |

|

Issue of share |

100000 |

Purchase of fixed assets |

70000 |

|

Sales of assets |

8000 |

Increase in WC |

130000 |

|

Funds from operation |

92000 |

|

|

|

|

200000 |

|

200000 |

2072 Set C Q. No. 16

Schedule

of changes in Working Capital

Funds flow statement

|

Source |

Amt. |

Application |

Amt. |

|

Issue of share |

70000 |

Increase in WC |

35000 |

|

FFO |

35000 |

Fixed assets purchase |

70000 |

|

|

105000 |

|

105000 |

2072 Set D Q. No. 16

Funds from operation

|

Particular |

Amt. |

Amt. |

|

Net profit for the year |

|

40000 |

|

Add: Non-operating expenses |

|

|

|

:- Goodwill written off |

2000 |

|

|

:- Dividend paid |

25000 |

|

|

:- Depreciation charged |

15000 |

42000 |

|

|

|

82000 |

|

Less: Non-operating income |

|

0 |

|

FFO |

|

82000 |

Fund flow Statement

|

Source |

Amt. |

Application |

Amt. |

|

Issue of share capital |

50000 |

Redemption of debenture |

50000 |

|

FFO |

82000 |

Dividend paid |

25000 |

|

Decrease in WC |

3000 |

Fixed assets purchased |

60000 |

|

|

135000 |

|

135000 |

2072 Set E Q. No. 16

Schedule

of changes in Working Capital

|

Source |

Amt. |

Application |

Amt. |

|

Issue of share |

100000 |

Purchase of fixed assets |

50000 |

|

FFO |

35000 |

Redemption of Loan |

40000 |

|

|

|

Increase in WC |

45000 |

|

|

135000 |

|

135000 |

2071 Supp. Q. No. 16

Funds from operation

|

Particular |

Amt. |

Amt. |

|

Net profit for the year |

|

100000 |

|

Add: Non-operating expenses |

|

|

|

:- Depreciation on assets |

50000 |

|

|

:- Goodwill written off |

5000 |

55000 |

|

|

|

155000 |

|

Less: Non-operating

incomes |

|

|

|

:- Profit on sales of fixed assets |

3000 |

(3000) |

|

FFO |

|

152000 |

Funds Flow Statement

|

Source |

Amt. |

Application |

Amt. |

|

Fund from operation |

152000 |

Purchased of fixed assets |

50000 |

|

Issue of share capital |

100000 |

Decrease in WC |

210000 |

|

Sales of fixed assets |

8000 |

|

260000 |

|

|

260000 |

|

|

2071 Set C Q. No. 16

Schedule

of changes in Working Capital

Funds flow statement

|

Source |

Amt. |

Application |

Amt. |

|

Issue of share capital |

100000 |

Machinery purchase |

85000 |

|

Funds from operation |

70000 |

Redemption of 7% debenture |

50000 |

|

|

|

Increase in WC |

35000 |

|

|

170000 |

|

170000 |

2071 Set D Q. No. 16

Funds from operation

|

Particular |

Amt. |

Amt. |

|

Net profit for the year |

|

30000 |

|

Add: Non-operating expenses |

|

|

|

:- Goodwill written off |

10000 |

|

|

:- Transfer to reserve |

10000 |

|

|

:- Dividend paid |

15000 |

|

|

:- Depreciation on machinery |

10000 |

45000 |

|

|

|

75000 |

|

Less: Non-operating income |

|

0 |

|

FFO |

|

75000 |

Funds flow statement

|

Source |

Amt. |

Application |

Amt. |

|

Issue of share capital |

50000 |

Machinery purchased |

100000 |

|

Funds from operation |

75000 |

Dividend paid |

15000 |

|

Decrease in WC |

20000 |

Transfer to reserve |

10000 |

|

|

125000 |

|

125000 |

2070 Supp. Q. No. 16

Schedule

of changes in Working Capital

Funds Flow statement

|

Source |

Amt. |

Application |

Amt. |

|

Issue of share capital |

50000 |

Increase in WC |

47000 |

|

Fund from operation |

13000 |

Purchase of fixed assets |

16000 |

|

|

63000 |

|

63000 |

2070 Set C Q. No. 16

Schedule

of changes in Working Capital

|

Particular |

Amt. |

Amt. |

|

Net profit for the year |

|

10000 |

|

Add: Non-operating expenses |

|

|

|

:- Depreciation charge in fixed assets |

20000 |

|

|

:- Tax paid |

5000 |

25000 |

|

|

|

30000 |

|

Less: Non-operating incomes |

|

|

|

:- profit on sale of machinery |

10000 |

(10000) |

|

FFO |

|

20000 |

2070 Set D Q. No. 16

Schedule

of changes in Working Capital

Funds from operation

|

Particular |

Amt. |

Amt. |

|

Net profit for the year |

|

80000 |

|

Add: Non-operating expenses |

|

|

|

:- Transfer to general reserve |

5000 |

|

|

:- Depreciation charge in fixed assets |

50000 |

|

|

:- Dividend paid |

20000 |

75000 |

|

|

|

155000 |

|

Less: Non-operating incomes |

|

|

|

:- profit on sale of machinery |

10000 |

(10000) |

|

FFO |

|

20000 |

2069 Supp. Set B Q. No. 16

Funds from operation

|

Particular |

Amt. |

Amt. |

|

Net profit for the year |

|

50000 |

|

Add: Non-operating expenses |

|

|

|

:- Goodwill written off |

35000 |

|

|

:- Dividend paid |

30000 |

|

|

:- Depreciation on fixed assets |

15000 |

80000 |

|

|

|

130000 |

|

Less: Non-operating income |

|

|

|

:- Profit on sale of fixed assets |

10000 |

(10000) |

|

FFO |

|

120000 |

Funds flow statement

|

Source |

Amt. |

Application |

Amt. |

|

Issue of share capital |

60000 |

Purchased of fixed assets |

100000 |

|

Funds from operation |

120000 |

Dividend paid |

30000 |

|

Sale of fixed assets |

150000 |

Increase in WC |

200000 |

|

|

330000 |

|

330000 |

2069 Supp. Set B Q. No. 16

Funds from operation

|

Particular |

Amt. |

Amt. |

|

Net profit for the year |

|

30000 |

|

Add: Non-operating expenses |

|

|

|

:- Goodwill written off |

5000 |

|

|

:- Dividend paid |

30000 |

|

|

:- Depreciation on fixed assets |

10000 |

45000 |

|

|

|

75000 |

|

Less: Non-operating income |

|

0 |

|

FFO |

|

75000 |

Funds flow statement

|

Source |

Amt. |

Application |

Amt. |

|

Issue of share capital |

100000 |

Fixed assets purchased |

150000 |

|

Funds from operation |

75000 |

Dividend paid |

30000 |

|

Decrease in WC |

35000 |

10% Debenture redemption |

30000 |

|

|

210000 |

|

210000 |